Ready to Hit the Road in Style?

Save money and reduce emissions with vehicles designed to deliver exceptional mileage. Visit our inventory and find a car that fits your lifestyle.

Ready to Hit the Road in Style?

Save money and reduce emissions with vehicles designed to deliver exceptional mileage. Visit our inventory and find a car that fits your lifestyle.

For the past two years, the Plug-in Hybrid Electric Vehicle (PHEV) was the darling of the Australian car market, especially for business and novated lease buyers. Driven by a generous Fringe Benefits Tax (FBT) exemption, sales boomed. It was a simple, compelling financial equation.

The Federal Government's FBT exemption for PHEVs was officially "sunsetted". The market's reaction was immediate and brutal: industry data shows PHEV sales saw a "sharp decline" the moment the subsidy was removed. This has left thousands of Australian car buyers standing at a crossroads, asking one, critical question:without the tax break, is a PHEV still worth buying?

As a car buyer, you are no longer just comparing fuel economy. You are navigating a complex financial decision that has been fundamentally reset. This guide will provide the definitive answer. We will break down the new financial reality, compare the ongoing costs, and identify the exact types of buyers who should and should not still consider a PHEV in 2026.

The Big Change: What Was the FBT Exemption & Why Did It End?

Before we can look forward, we must understand what just happened. This wasn't a minor tweak; it was the removal of the single biggest financial incentive for buying a new PHEV.

A Simple Guide to the FBT Exemption

In short, Fringe Benefits Tax (FBT) is a tax employers pay on the value of non-cash benefits provided to employees, like a company car or a novated lease.

The FBT exemption, introduced as part of the Electric Car Discount, made certain low-emission vehicles (BEVs and, at the time, PHEVs) exempt from this tax. For an employee on a $100,000 salary, this benefit could slash their novated lease payments by thousands of dollars per year. It effectively meant the government was co-funding your car.

This policy was wildly successful. In March 2025, the month before the deadline, sales of PHEVs spiked by an astonishing 380% as buyers rushed to lock in the benefit.

Why It Was Removed

The government's rationale was that the exemption had done its job: to "kick-start" the market. With sales surging, it was determined that PHEVs no longer needed the subsidy. From April 1, 2025, PHEVs are no longer considered "zero or low emissions vehicles" under FBT law and are now taxed just like any other petrol or diesel car.

The only vehicles that still qualify for the FBT exemption are full Battery Electric Vehicles (BEVs) and hydrogen fuel-cell vehicles. This single policy change has completely rewritten the value equation.

The "Transitional" Clause: Does Anyone Still Qualify?

There is one small, critical exception. According to the Australian Taxation Office (ATO), the FBT exemption can continue to apply if you had a "financially binding commitment" to provide the car before April 1, 2025.

This is a "legacy" arrangement. If you're walking into a dealership today, this does not apply to you. Any new PHEV purchase or lease arrangement is subject to the new, full-FBT rules.

The New Financial Reality: Does a PHEV Still Make Sense?

With the FBT subsidy gone, the case for a PHEV rests on two much simpler pillars: a higher purchase price versus long-term running cost savings. We must do the new math.

The "PHEV Premium"

A PHEV is essentially two cars in one: it has a full petrol engine and a large electric motor and battery pack. This complexity makes it more expensive. Let's use Australia's most-debated match-up as an example: the Toyota RAV4 Hybrid vs. the Mitsubishi Outlander PHEV. The Toyota RAV4 Hybrid (a "self-charging" hybrid, or HEV) is cheaper to buy.

The Mitsubishi Outlander PHEV has a significant "PHEV premium" in its sticker price, often thousands of dollars more than a comparable RAV4. Before, the FBT exemption could wipe out this "premium" in 2-3 years. Now, that premium is paid entirely by you. The only way to earn it back is through fuel and maintenance savings.

The Private Buyer

If you're a private buyer (not using a novated lease), the FBT change means... nothing. You never received the benefit in the first place. For you, the equation has always been:

(Higher Purchase Price) ÷ (Annual Fuel Savings) = Payback Period

A PHEV's fuel savings are entirely dependent on your lifestyle. A model like the Outlander PHEV has an electric-only range of up to 84km.

If you charge at home every night and your daily commute is under 80km, your petrol usage will be near zero. You'll run on cheap, off-peak electricity. In this scenario, your fuel savings are massive, and you can pay back the "PHEV premium."

If you don't charge at home and drive long distances, a PHEV is just a very heavy, complicated petrol car. You're hauling around a dead battery, and your fuel economy may be worse than a simpler, lighter "self-charging" hybrid.

The Business / Novated Lease Buyer

This is where the calculation has changed most dramatically.

Old Math (Pre-April 2025): (PHEV Lease) - (Huge FBT Exemption) + (Fuel Savings) = Huge Win.

New Math (Post-April 2025): (PHEV Lease) + (Full FBT) + (Fuel Savings) = It's complicated.

The FBT exemption is now only available for full BEVs. Therefore, any business or novated lease buyer must now compare the total cost of a PHEV against a full BEV. In almost all scenarios, the BEV will now be the clear financial winner on tax savings alone. The PHEV has lost its primary competitive advantage in this market.

PHEV vs. "Self-Charging" Hybrid (HEV): The New Showdown

The FBT change has reignited the market's biggest-selling rivalry: the "plug-in" specialist vs. the "self-charging" all-rounder.

The Case for the HEV (e.g., Toyota RAV4 Hybrid)

The "self-charging" hybrid, popularised by Toyota , is the new "default" logical choice for most people.

Simplicity: It works like a normal car. You just put petrol in it.

Cheaper to Buy: The sticker price is significantly lower than a PHEV.

Efficient Everywhere: The hybrid system works in city traffic and on the highway, sipping fuel at a consistent 4.7L/100km.

Lower Servicing Costs: A Toyota HEV, for example, has famously low capped-price servicing costs. A more complex PHEV from another brand can have higher annual servicing bills.

The Case for the PHEV (e.g., Mitsubishi Outlander PHEV)

A PHEV is now a specialist tool. It only wins if you use it exactly as designed.

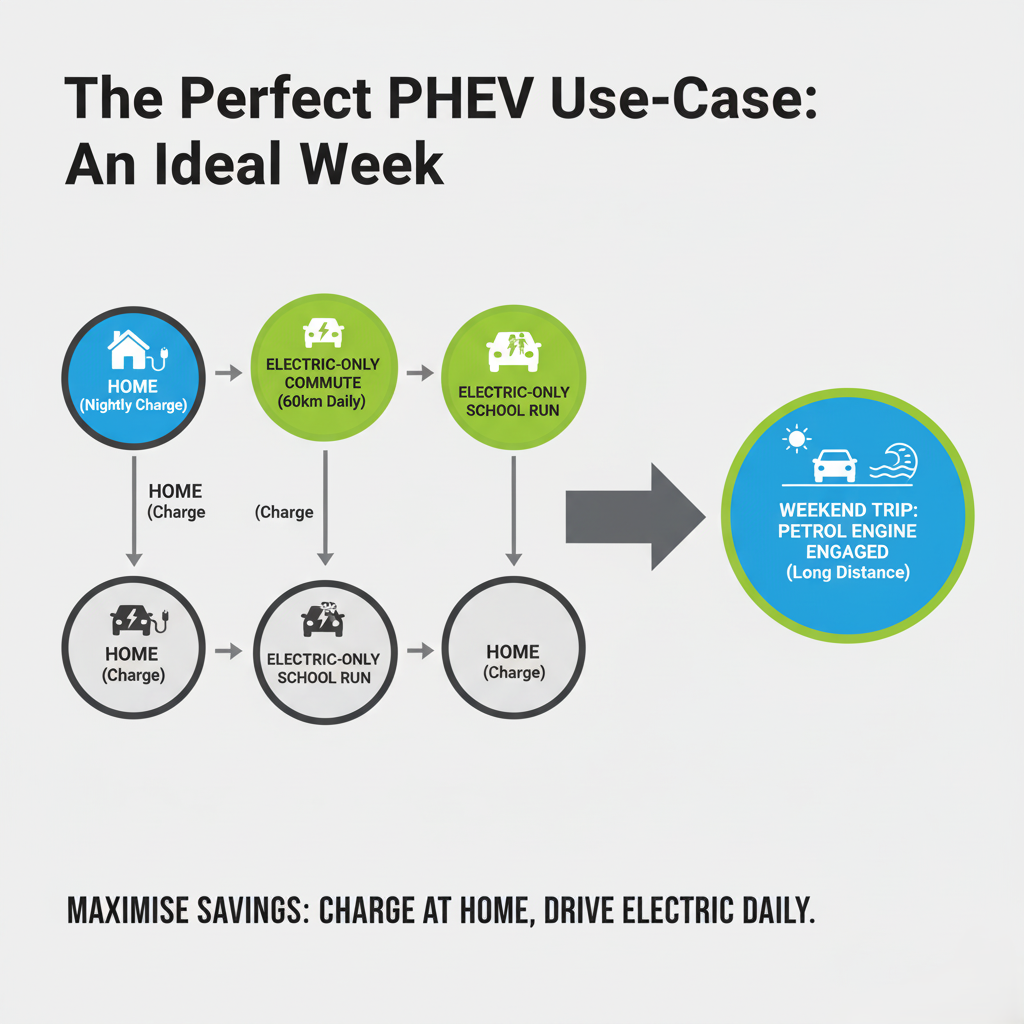

The 90/10 Split: It's designed for someone who drives 90% of the time on pure electricity (short commutes, school runs) and 10% on petrol (long weekend trips).

The "At-Home" Charger: The value proposition collapses if you can't charge at home. This is not a car for apartment dwellers with on-street parking.

Performance: A PHEV is often more powerful. The dual motors in an Outlander PHEV provide 248 horsepower, far more than the RAV4's 219.

The Unique Insight: The "Real-World Fuel Economy" trap is a critical factor. An Australian Automobile Association (AAA) study found some hybrids use up to 33% more fuel in real-world driving than their lab tests suggest. A PHEV driven without charge is the worst offender. A "self-charging" HEV is more "foolproof" and will deliver its advertised efficiency more reliably, regardless of driver behaviour.

Who Should Still Buy a PHEV in 2026?

Despite the FBT change, a PHEV is still the perfect car for a few specific buyer personas.

The "Pure EV" Commuter with One Car

Who you are: You have a garage or carport with a power point. Your daily round-trip commute is under 80km. You are disciplined and will plug your car in every single night.

Why it works: You will spend 95% of your year in a "pure EV" mode, running on cheap electricity. Your fuel bill will be near zero. The petrol engine is just your "peace of mind" backup for the one or two long road trips you take each year. You get the EV experience without the "range anxiety". This is the ideal PHEV owner.

The "One Car for Everything" Family

Who you are: You need a 7-seater SUV (like a Kia Sorento PHEV or Outlander PHEV ) for school, sports, and family holidays. You want to be green, but a full BEV (like the Kia EV9) is too expensive, and you need the flexibility to drive 500km to a holiday house without planning charging stops. Why it works: The PHEV is your "best of both worlds" compromise. You get electric-only school runs, but the petrol engine gives you ultimate freedom. You're willing to pay the "PHEV premium" for this flexibility.

The "Tech-Forward" Tradie or Ute Owner

Who you are: You're a tradie, a site manager, or a lifestyle enthusiast. You've been eyeing the new wave of PHEV utes like the BYD Shark 6 or Ford Ranger PHEV. Why it works: Your interest isn't just fuel savings; it's Vehicle-to-Load (V2L). The large battery in your PHEV ute acts as a mobile power station, allowing you to run power tools, a fridge, or a campsite without a separate generator. This is a utility feature that no other drivetrain can offer, and it's immensely valuable.

The Alternatives: What to Buy Instead of a PHEV

For everyone else, particularly the novated lease buyers, the FBT change has pushed these three alternatives to the front of the line.

The "Self-Charging" Hybrid (HEV)

This is the new "no-brainer". For 90% of Australian buyers, a Toyota RAV4 Hybrid, Corolla Hybrid, or Hyundai Tucson Hybrid is now the superior financial choice. It's cheaper to buy, simple to own, has brilliant resale value, and is incredibly fuel-efficient in all conditions.

The Full Battery EV (BEV)

If you are a novated lease buyer, this is your new starting point. The FBT exemption still applies to BEVs. This means a full EV (like a Tesla Model Y or BYD Sealion) could now be significantly cheaper to run over a 5-year lease than a PHEV, which now attracts the full FBT. The government is no longer "neutral"; it is actively and powerfully incentivising you to skip the hybrid step entirely.

The Modern, Efficient Petrol Car

Let's be pragmatic. A standard, non-hybrid petrol SUV is still thousands of dollars cheaper to buy than any hybrid equivalent. It takes many years of fuel savings to close that gap. If you don't drive high kilometres (e.g., under 15,000km/year), the cheapest and simplest option may still be a modern, efficient petrol car.

Quick Takeaways

The FBT exemption for PHEVs ended on April 1, 2025. This was the primary financial driver for their sales boom.

PHEVs are now "specialist" vehicles. Their value depends entirely on you charging them every night and using them for short, electric-only trips.

PHEVs are more complex. They have two drive systems, which can mean higher purchase prices and potentially higher servicing costs.

For Novated Lease Buyers: A full BEV is now almost certainly the superior financial choice, as it retains the FBT exemption.

For Most Private Buyers: A "self-charging" hybrid (HEV) like a Toyota RAV4 is cheaper, simpler, and the more logical, "foolproof" financial decision.

PHEVs are NOT dead. They are the perfect solution for specific users: the "at-home" EV commuter, the "one-car" family needing flexibility, and the "tradie" who needs V2L power.

The Final Verdict

So, are PHEVs still worth it in Australia?

For most people, and especially for novated lease buyers, the answer is no. The FBT change has removed the primary financial incentive, and the "PHEV premium" is now too high to justify for a typical driver. The complexity, higher servicing costs, and reliance on a disciplined charging routine make it a financial gamble. A "self-charging" hybrid is a safer, cheaper, and simpler bet. A full BEV is the new tax-advantaged king.

However, a PHEV is not a "bad" car. It is simply a specialist tool.

If you are the perfect-use-case-buyer with a garage charger, a sub-80km daily commute, and a regular need for long-distance family trips, then a PHEV is still the only car on the market that can be all things at once. It can be a zero-emission commuter Monday to Friday and a go-anywhere family car on Saturday.

Before the FBT change, a PHEV was an easy financial decision. Today, it is a deliberate lifestyle decision. Before you buy, do the new math, be honest about your charging habits, and book a test drive in a "self-charging" hybrid first. The smart money is no longer on the fence.

Why Choose Carbarn Australia?

Navigating this new market is confusing. The rules have changed, and the "best" car for your neighbour is no longer the "best" car for you. At Carbarn Australia, we believe in transparency. Our job isn't just to sell you a car; it's to provide the clarity you need to make the right financial decision for your family. We were on top of the FBT change from day one, and our team is trained to do the "new math" with you.

We'll sit down and compare the true 5-year ownership costs of a PHEV, a "self-charging" hybrid, and an efficient petrol model. We'll ask you about your commute, your charging setup, and your lifestyle before we ever recommend a vehicle. In a market full of confusion, trust the experts who do the research. Explore our range of hand-picked, quality-guaranteed hybrids, PHEVs, and efficient petrol cars, and let us help you find the car that is actually worth it.